Relevant Posts

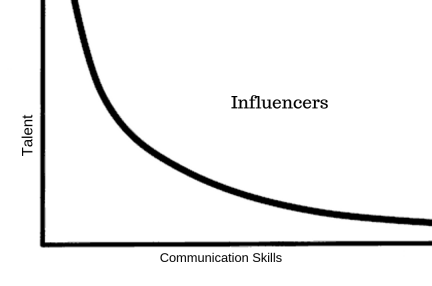

What Counts as Sales, and What Doesn’t: A Guide for Influencers

Understanding what constitutes sales and taxable income is crucial for influencers to ensure compliance with tax obligations. This guide delves into the various sources of income that influencers may encounter, clarifies what counts as taxable and non-taxable items, and provides methods for valuing in-kind benefits. Taxable Income: Breakdown of Different Income Types As an influencer, […]

Continue ReadingTax Compliance for Influencers: HMRC’s Nudge Letters and What They Mean

Tax Compliance for Influencers: HMRC’s Nudge Letters and What They Mean In recent years, the rise of social media influencers has brought a new dimension to the world of taxation. HM Revenue & Customs (HMRC) has taken notice and has begun issuing “nudge letters” to influencers, reminding them of their tax obligations. Understanding these letters […]

Continue ReadingFoster a Positive Work Culture: The Heart of Your Business

In the relentless pursuit of performance metrics and profitability, the essence of a thriving business often boils down to something more fundamental: its work culture. A positive work culture is not just a peripheral benefit but the very heart of a successful business strategy. It is the soil from which innovation, commitment, and excellence grow. […]

Continue ReadingEmbrace Technology: Leverage AI and Digital Tools

In the current business landscape, where efficiency and customer satisfaction are paramount, the integration of technology stands out as a beacon for progress. Particularly for small businesses, the strategic adoption of artificial intelligence (AI) and digital tools can be transformative, offering a pathway to streamlined operations, enhanced customer experiences, and the discovery of new growth […]

Continue Reading